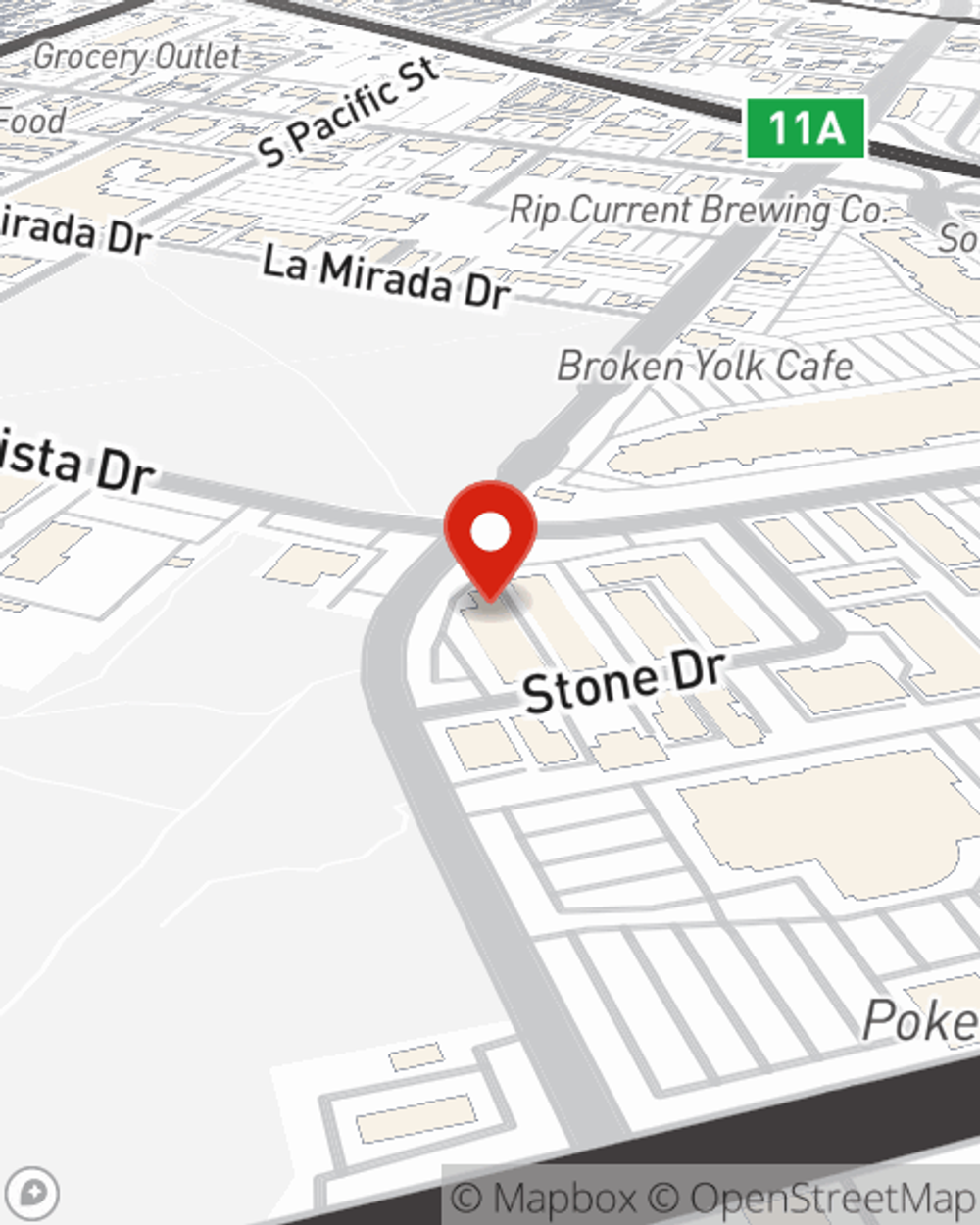

Business Insurance in and around San Marcos

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

Running a business is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for everyone you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, a surety or fidelity bond and errors and omissions liability.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Strictly Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a floral shop, a beauty salon, or a gift shop, having the right insurance for you is important. As a business owner, as well, State Farm agent John Hadley understands and is happy to offer exceptional service to fit what you need.

Call or email agent John Hadley to consider your small business coverage options today.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

John Hadley

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.